Two years had passed since the Watergate scandal broke, and less than a year since President Nixon had resigned, but the reverberations of the scandal were still rocking Washington. Its revelation that multinational corporations, including some of the most prestigious brands in the United States, had been making illegal contributions to political parties not only at home but in foreign countries around the world would later be described by Ray Garrett, the chairman of the SEC, as “the second half of Watergate, and by far the larger half.”

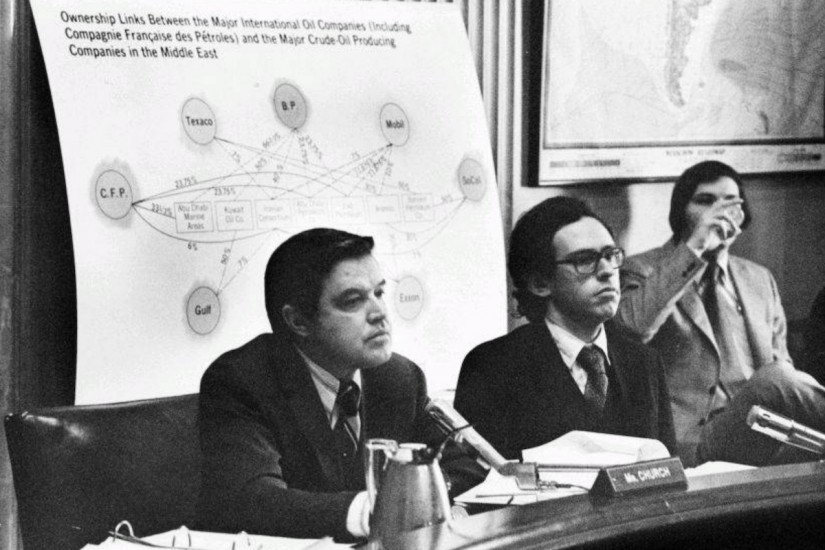

By 1975, Frank Church of Idaho had convened a Senate Subcommittee on Multinational Corporations to examine, as one of his colleagues said, “U.S. corporate business practices abroad” and to “ascertain the impact of these practices on U.S. foreign policy.” Each night Sporkin would return home from work and watch the hearings on television. One evening in mid-May he listened to Robert Dorsey, the chairman of the board of Gulf Oil, testify before the committee. Dorsey admitted that between 1966 and 1970 Gulf Oil had paid $4 million in bribes to the Democratic Republican Party of South Korea, funds principally intended to support the party’s re-election campaign in 1971. Dorsey went on to explain how Gulf funneled the money: “Although each of the contributions came from company funds in the United States, the transfers were recorded as an advance to Bahamas Exploration Co. Ltd., where they reflected on the books and records of Bahamas Exploration Co., as an expense.”

Sporkin was beside himself. In addition to being an attorney, he had also been trained as a certified public accountant and wanted to know more about how Gulf’s slush fund worked. He got a member of his staff, Robert Ryan, on the phone, and told him, “I want you to go to the company and find out what happened here, how they did it.” Gulf Oil executives candidly explained to Ryan that they had moved the money by transferring it from Gulf to the bank account in the Bahamas in amounts small enough to avoid suspicion from the IRS and external auditors. Most important, they confirmed Dorsey’s testimony that they had falsely recorded the payments as deferred charges that were written off as expenses.

At the time, there was no law that specifically prohibited a U.S. corporation from bribing a foreign government official, although several existing statutes, including the Bank Secrecy Act, the RICO laws, and provisions of the IRS’s criminal code were applicable to how a bribe was paid and how it might be covered up. But what really struck Sporkin was that whereas businesses had to keep books, there was no federal law requiring publicly traded companies to keep honest books and records. “It was inconceivable to me,” he recalled, “that companies could be bribing all over the world, and the shareholders not know how they’re making their money.”